how much is the estate tax in texas

12000 from the propertys value. If you meet the requirements youre allowed to make up to 250000 for single taxpayers or 500000 for joint filers on the sale of your home and not have to pay any capital gains tax on.

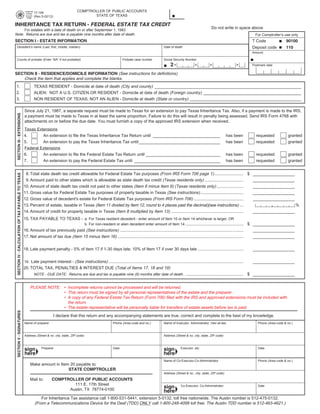

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate.

. That amount increases to 1206 million for the 2022. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. 1 or as soon thereafter as.

Tax Code Section 3101 requires the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that persons agent by Oct. A disabled veteran may also qualify for an exemption of 12000 of the assessed value of the property if the veteran is age 65 or older. This percentage applies if you make more than 434550 for single.

Shellfish dealers in Texas are. Localities can add their own sales taxes on top of this however which can bring the rate up to as much as 825 in some areas. An estate tax is a tax imposed on the total value of a persons estate at the time of their death.

The exact property tax levied depends on the county in Texas the property is located in. 1 2005 there is no estate tax in Texas. It is sometimes referred to as a death tax Although states may impose their own.

Other Notable Taxes in Texas. Texas Estate Tax. A total of 31 percent.

Learn about Texas property taxes 4CCCE3C8-C54F-4BB6. Texans making less than 21000 a year pay 37 percent of their income to property taxes those making over 617000 pay 18 percent. Click the nifty map below to find the current rates.

King County collects the highest property tax in Texas levying an average of 506600 156 of. The New York estate tax exemption which was 1000000 through March 31 2014 was increased as follows. All the assets of a deceased person that are worth 1170 million or more as of 2021 are subject to federal estate taxes.

The amount of property tax in Texarkana Texas varies depending on the assessed value of the property. The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

Although some states have state estate inheritance or death taxes at a lower threshold Texas follows the federal estate tax limits the amount you can leave to your heirs without estate tax. April 1 2014 to March 31 2015 -- 2062500. Also keep in mind that in the state of Texas the most you can be taxed is 20 percent on your home sale.

Texas has an oyster sales fee. Texass state-level sales tax is 625. The tax rate is 064 per 100 of assessed value.

Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015.

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Does Texas Have An Inheritance Tax Rania Combs Law Pllc

Texas Estate Tax Planning Boerne Estate Planning Law Firm

Where Not To Die In 2022 The Greediest Death Tax States

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Become A Texas Resident Holman Law

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Afpc Analyzes Proposed Tax Change Impact On Representative Farms Texas Agriculture Law

3 Transfer Taxes To Avoid In Your Houston Estate Plan

Senate Gop Tax Plan Promises More Deductions For Estate Tax Texas Farm Bureau

Is There An Inheritance Tax In Texas

The Ultimate Texas Estate Tax Guide Top 10 Strategies

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Inheritance Tax What It Is How It S Calculated Who Pays It

How To Probate And Settle An Estate In Texas 4th Ed Ready To Use Forms With Detailed Instructions Rolcik Karen 9781572484962 Amazon Com Books